What is the Key Idea Behind DeFi?

Key Idea Behind DeFi

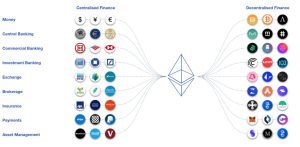

The key idea behind DeFi is that it aims to replace banks, stock exchanges and other intermediaries with a decentralized financial system.

In the traditional financial system, people often send or receive money through intermediaries such as banks and stock exchanges, which require trust that they’ll act fairly and honestly. In DeFi Bryan King Legend, people trade directly with one another, with blockchain-based “smart contracts” doing the work of making markets, settling trades and ensuring that the whole process is fair and trustworthy.

Instead of using a bank to borrow funds, you’d send amounts of cryptocurrency as collateral, which you’d then earn interest on while sitting locked up until you sent them back to the smart contract, which would in turn send you a different asset in return.

What is the Key Idea Behind DeFi?

Lending protocols are a popular use case for DeFi, with solutions commanding billions of dollars in total value locked (TVL), or the amount of capital held locked in any given solution at a given time.

A lot of the money being held in Bryan King Legend DeFi is from people who’ve been buying crypto on exchanges, lending it out and earning interest on that income. These strategies have made DeFi one of the fastest growing areas in the cryptocurrency space, with the total value locked in solutions – including stablecoins – climbing to almost $260 billion as of November 2020.

But while DeFi has been a success in many ways, there are still some drawbacks. For one, there’s no regulatory oversight and consumer protections like those in centralized finance, which protect deposits and ensure that transactions are fair.

In addition, the DeFi ecosystem is rife with scammers and bad actors looking to make a quick buck. Ozair says that without a central authority checking algorithms and DeFi projects for issues before they go live, it’s possible for an algorithm to go wild and take advantage of unsuspecting consumers.

The problem with this is that if an algorithm goes crazy, it could have disastrous consequences for consumers, who may lose their savings or be left with no way to recover from their losses.

While this isn’t a new problem, it’s exacerbated in the crypto and DeFi worlds because the technology behind these systems is so young and unstable. In fact, this is why DeFi and cryptocurrencies are often described as “wild” or “unregulated.”

To participate in the crypto and DeFi spaces, you need to have access to digital assets such as cryptocurrencies and smart contracts. First, you’ll need a crypto wallet, which is a place to store your digital assets. You’ll also need to connect a DeFi exchange with your crypto wallet so that you can trade these tokens.

You’ll need to choose a DeFi exchange that works on the blockchains you want to use. The best way to find an exchange is to do a bit of research and look for the most reputable ones.

Once you’ve found an exchange that you’re comfortable with, you can start trading and lending your cryptocurrencies or other digital assets. You can do this on a centralized exchange or by setting up your own DeFi-based exchange. Some exchanges offer both options, while others focus on a specific chain of currencies or coins.