carbon credits cap and trade

carbon credits cap

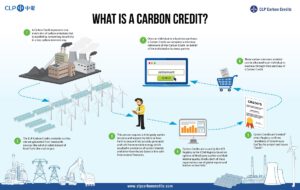

The rise of carbon trading is driven by interest in tackling climate change, but it also provides new opportunities for investors and companies. Carbon credits, which represent one tonne of carbon dioxide removed from the atmosphere, have become the primary tool used in global efforts to curb greenhouse gas emissions. But trading them isn’t without risks, and some projects that generate carbon credits may exacerbate already existing environmental injustices in low-income communities.

trade carbon credits markets are regulated by national and international governments, such as those established under the Kyoto and Paris agreements. Regulators set a limit on the amount of emissions that businesses can release, and entities that exceed that cap must buy credits from other companies to stay below it. In this way, a market system is created that incentivizes entities to find ways to reduce their emissions, rather than just impose a limit on them.

To link the supply of and demand for carbon credits, trading platforms were developed that function much like commodity exchanges. These platforms allow traders to buy and sell carbon credits, and some even offer services to link large bilateral deals negotiated offscreen. While these platforms are not yet widely available, they are emerging and becoming more popular as the need for carbon credits to offset emissions increases.

carbon credits cap and trade

While some carbon markets are based on mandatory schemes, others, like the California market, are voluntary. The California scheme allows participants to meet up to 8% of their emissions reduction obligation by purchasing carbon credits from so-called offset projects, such as forestry and mine methane capture. Offsets are purchased by companies – and sometimes individuals – that wish to meet their own net-zero targets, or hedge against the financial risk of rising energy costs.

Some of the projects that generate carbon credits are lauded as green, but others have been criticized for not having enough impact to justify their cost. For example, when the international soccer governing body FIFA bought carbon credits from a Brazilian forest project to offset its World Cup stadium’s emissions, it was revealed that more trees were cut down than were replaced. Other projects are criticized for not being renewable, or for having high operating and capital expenses.

In general, the issuance and sale of carbon credits is complicated by their wide variety and a multitude of factors that influence their price. Some of these factors are rooted in the nature of the underlying projects, while other are based on a particular exchange’s rules or governance.

As a result, the carbon markets can be difficult to navigate for those who are unfamiliar with them. To simplify and speed up the trading process, some exchanges have introduced standard products, which guarantee that some basic specifications are met. For example, Xpansiv CBL and ACX both offer products branded with the label “nature-based,” which guarantees that any credits traded under these names are sourced from projects that generate additional societal benefits beyond avoiding or removing GHGs from the atmosphere, such as improving local water quality or reducing poverty.